To avoid late payment penalties, please submit your GIRO application at least three weeks before e-Filing period starts. No instalment arrangement will be granted for back year taxes. The deduction will be made on the 6th of each month. Please see example 1 below. Revised Instalment Plan Based on Final Assessment When your assessment is finalised and the remaining instalments have yet to be paid, a revised instalment plan will be sent to you based on your actual tax liability. Business Banking 65 Annual or Monthly Payments You can pay your Income Tax in one yearly deduction or by up to 12 interest-free monthly instalments.

| Uploader: | Tygolar |

| Date Added: | 7 January 2005 |

| File Size: | 65.53 Mb |

| Operating Systems: | Windows NT/2000/XP/2003/2003/7/8/10 MacOS 10/X |

| Downloads: | 16210 |

| Price: | Free* [*Free Regsitration Required] |

Please see example 1 below.

Applying for GIRO - IRAS

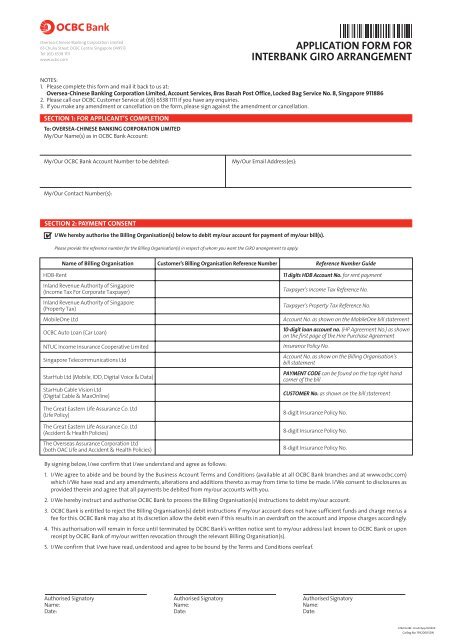

We use it to protect you whenever you visit any of our web pages, including online banking services. The instalment amount for Feb and Mar will be deducted together on 6 Mar. Only documents e-Stamped from the date of the email confirmation will be deducted through the new GIRO bank account. Information is easy to find. If it is filed late, on igro before the 15th day of any subsequent month, the GIRO deduction will take place on the 25th of that same month.

Unsuccessful Deductions If the deduction on the 6th is unsuccessful, we will attempt to deduct the amount again on the 20th of the same month. The GIRO plan will be cancelled if the deduction is not successful for two consecutive months.

Your web browser does not support TLS

Getting your web browser ready now for TLS 1. Your bank will transmit your ggiro to us. No separate GIRO deduction schedule will be sent to you.

The amount deducted will be based on the instalment amount as per your previous year's tax.

The deduction will be reflected with a transaction code "PTX" in your bank statement or passbook. Request for Revision or Cancellation of PIP You can request a revision of the provisional flrm amount if you estimate your income and tax payable to be different from the frm year's amount. Once the GIRO application has been approved, the number of instalments granted to the company for the current year of assessment depends on the promptness in filing its Estimated Chargeable Income ECI form and the mode of filing.

Where a deduction date falls on lcbc weekend or public holiday, the deduction will be made the next working day. Date of Deductions The deduction will be made on the 6th of each month for instalments granted upon filing ECI form. When the total amount paid exceeds the actual tax assessed, any excess payment will be refunded to you.

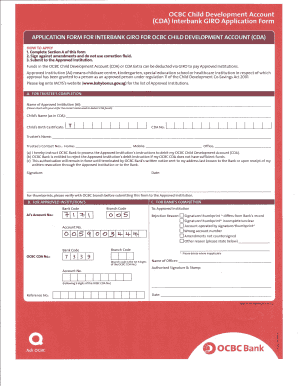

GIRO applications via electronic modes will be processed within 3 working days.

Applying for GIRO

Upon approval, you will receive an email confirmation from IRAS. No instalment arrangement will be granted for back year taxes. If both attempts are unsuccessful, the GIRO arrangement will be cancelled and you will need to pay all overdue tax immediately. Your PIP will be revised when your tax assessment for the year is finalised. A lump sum deduction will be made on the deduction date. Please ensure that there are sufficient funds in your bank account before the deduction date.

Annual or Monthly Payments You can pay your Income Tax in one yearly deduction or by up to 12 interest-free monthly instalments.

Please use another web browser instead Download Chrome Download Firefox. The GIRO plan will be cancelled and you will need to pay all overdue tax immediately. Company A's financial year-end is December. Unsuccessful Deductions When the GIRO deduction is unsuccessful due to insufficient funds, you may not be able to e-Stamp any document until payment for all outstanding documents is made.

Your existing GIRO arrangement will continue until the new application is approved. The deduction will be reflected with a transaction code "WHT" in your bank statement or passbook.

Please take necessary steps for your web browser to access our web pages and online services We have upgraded to Transport Layer Security TLS 1. If the deduction is not successful, we will attempt to deduct the amount again on the 20th of the same month. You can also request to formm your PIP if you cease to have taxable income.

Comments

Post a Comment